- Blog

Everything You Need To Know About PPAs

Power Purchase Agreements (PPAs) are standard mechanisms used in the energy sector to purchase electricity from independent power producers. PPAs are contractual agreements between a power generator and a power purchaser that outline the terms of the sale and purchase of electricity. Bitcoin mining involves a significant amount of computational power and energy consumption. As a result, Bitcoin miners are always looking for ways to secure a reliable and cost-effective electricity supply to power their mining operations.

One solution that many Bitcoin miners are adopting is using PPAs, which allow them to purchase electricity from a power generator or independent power producer at a fixed price, ensuring a steady and predictable power supply. In this article, we will provide a comprehensive overview of everything you need to know about PPAs, including the parties involved, the types of PPAs, the critical elements of a PPA, the benefits and challenges of entering into a PPA, and more.

Sections:

- Parties Involved

- Elements of a PPA

- Demand Response in a PPA

- Types of PPAs

- Benefits and Challenges

Parties Involved

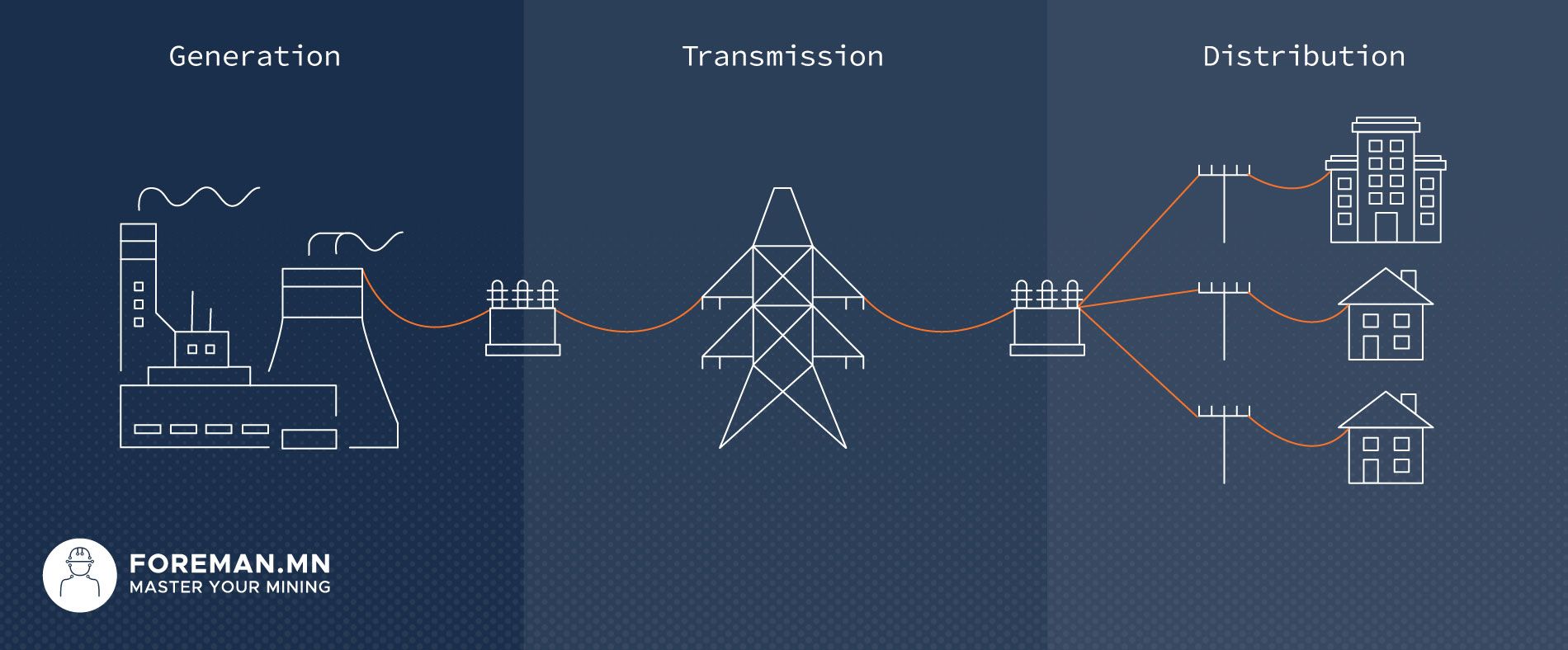

In a Power Purchase Agreement (PPA), two main parties are typically involved: the power generator and the power purchaser. For Bitcoin miners, the power generator is responsible for producing the electricity used to power mining equipment. This can be a company or organization that owns and operates a power plant or energy facility, such as a natural gas plant or hydroelectric dam. The power generator may also be an independent power producer (IPP) specializing in producing and selling electricity to other parties.

On the other hand, the power purchaser is responsible for buying the electricity produced by the power generator under the terms of the PPA. In the case of Bitcoin mining, the power purchaser is the mining company or individual miner who uses the electricity to power their mining operations. By entering into a PPA, Bitcoin miners can secure a long-term electricity supply at a fixed price, helping to manage the costs of mining operations and mitigate the risks associated with fluctuating energy prices.

While the power generator and power purchaser are the main parties involved in a PPA, a third party may also be involved in some cases. For example, a financing institution may provide funding for the power generation project, or a transmission and distribution utility may be responsible for delivering the electricity from the power generator to the mining facility. The roles and responsibilities of each party are defined in the PPA, which serves as the legal framework for the sale and purchase of electricity for Bitcoin mining operations.

Elements of a PPA

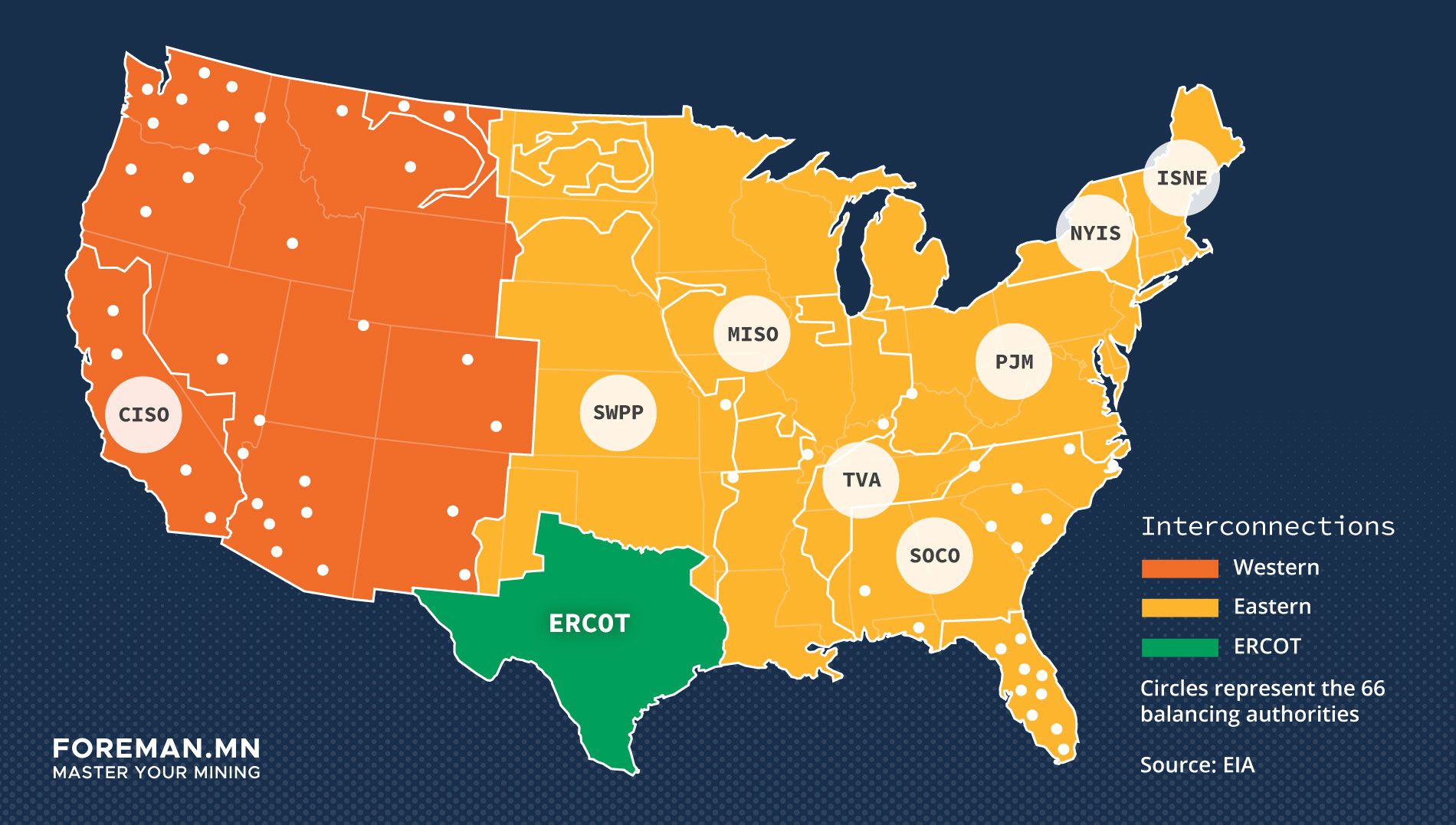

In the context of Power Purchase Agreements (PPAs) for Bitcoin miners, the main elements typically include the quantity of electricity, delivery schedule, pricing, term, performance guarantee, termination, and payment terms. They can vary from each ISO, like ERCOT, PJM, or others. The quantity of electricity outlines the amount of electricity the power generator must supply to the miner. At the same time, the delivery schedule specifies the time frame for the delivery of electricity to ensure a reliable and consistent supply of energy for the miner’s operations.

Pricing is a critical element of a PPA and outlines the price the miner will pay for the electricity. The pricing can be fixed or variable, depending on market conditions, and can significantly impact the profitability of the mining operation. The term of the PPA specifies the length of the contract, which can range from short-term to long-term and depends on the specific needs of the miner.

Performance guarantee is another critical element of the PPA, which outlines the power generator’s commitment to providing a certain level of reliability and performance in delivering electricity. The termination clause outlines the circumstances under which the contract can be terminated, such as breach of contract or ‘Forces Majeure’ events.

Finally, payment terms specify the terms and frequency of payments to the power generator for the electricity supplied. Overall, these elements help ensure a reliable and cost-effective electricity supply for Bitcoin miners, helping them mitigate risks associated with energy price volatility and availability and operate their mining operations more efficiently.

Demand Response in PPAs

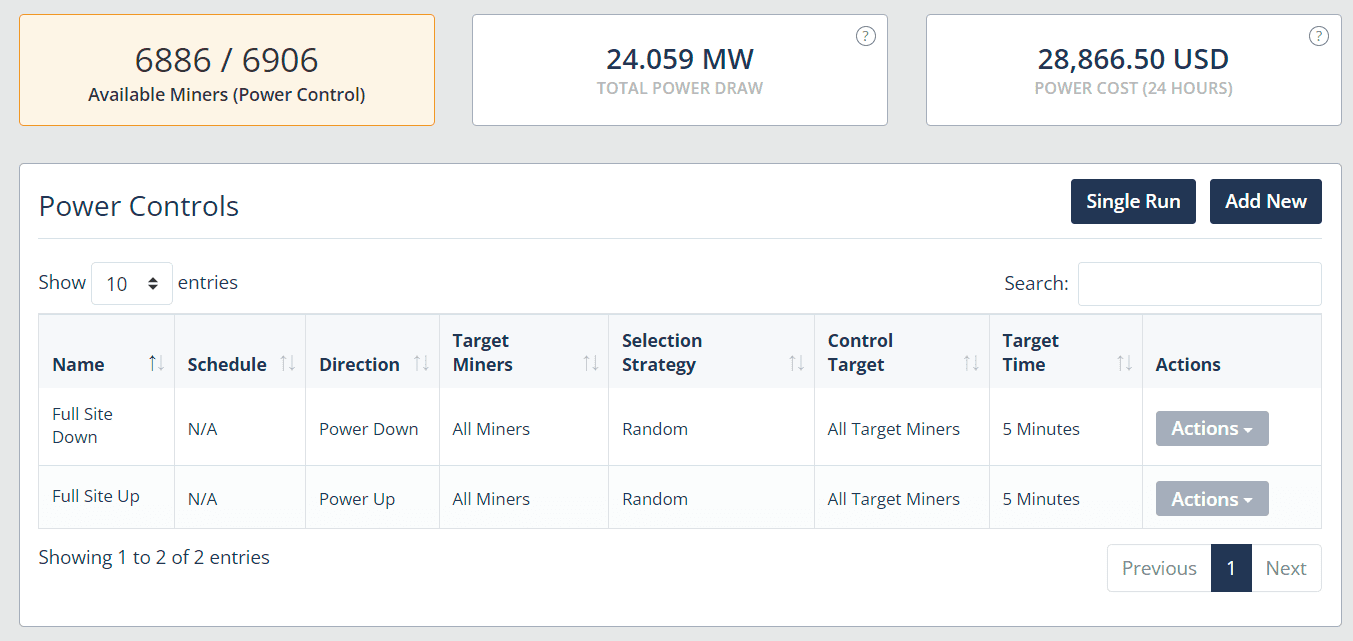

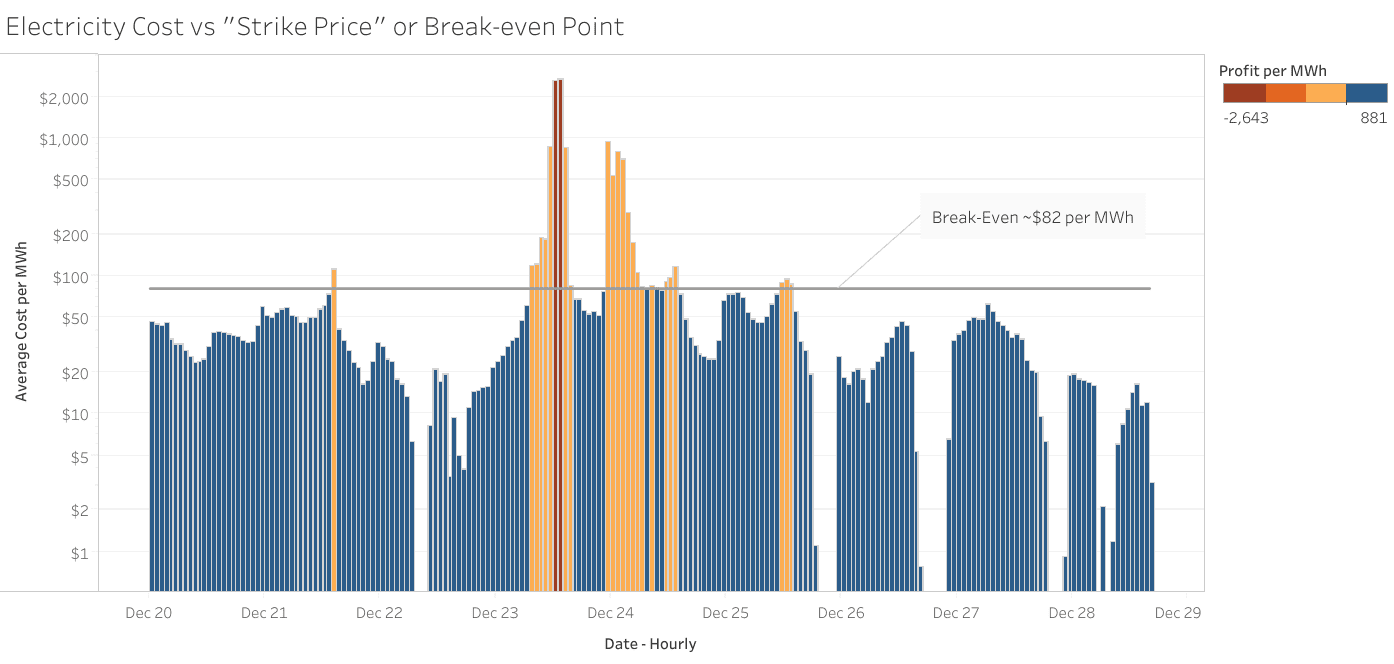

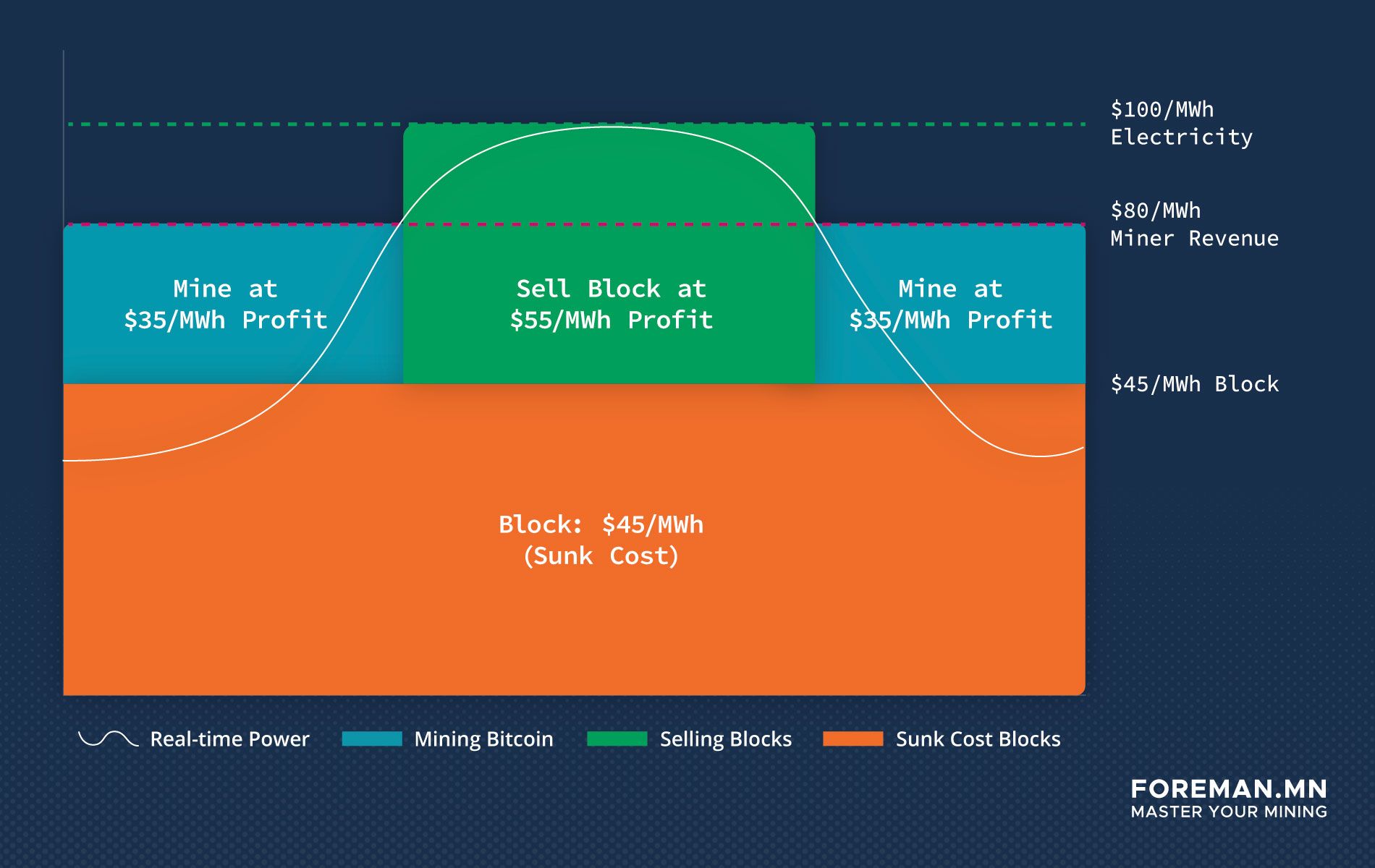

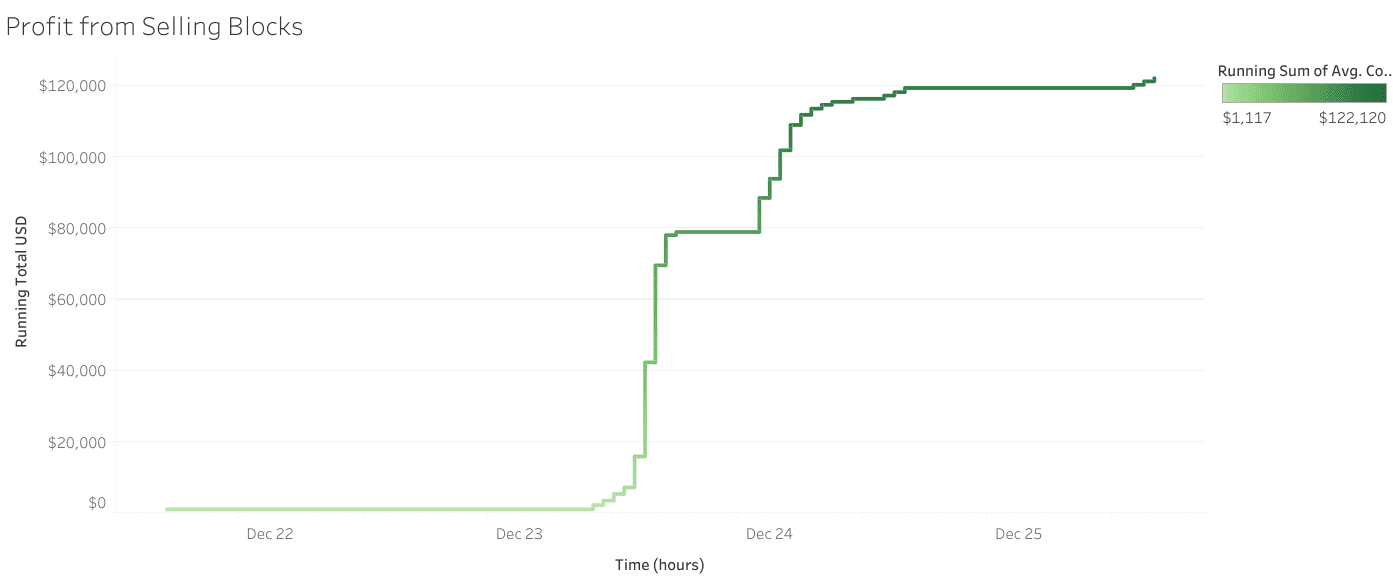

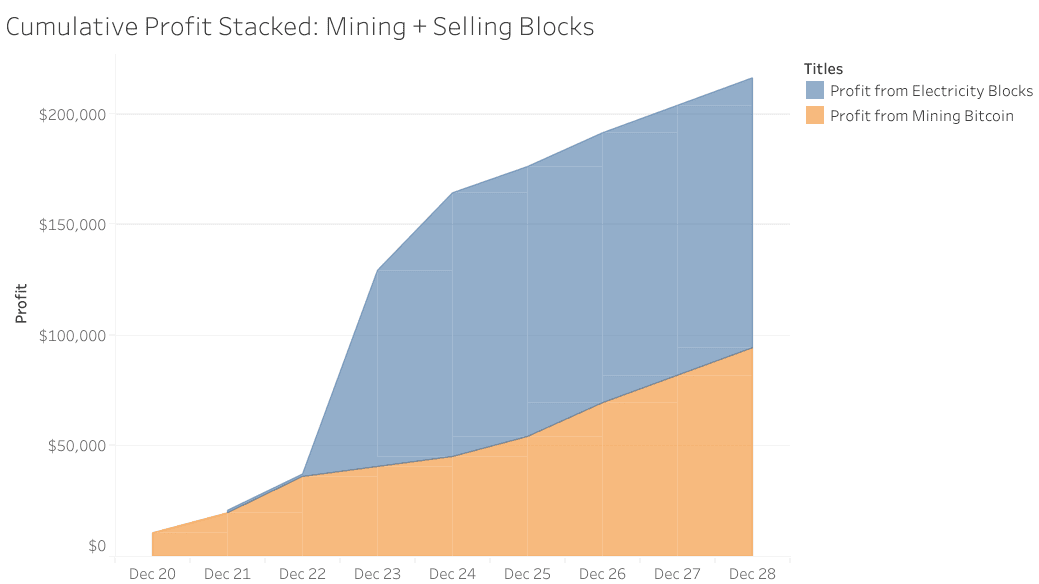

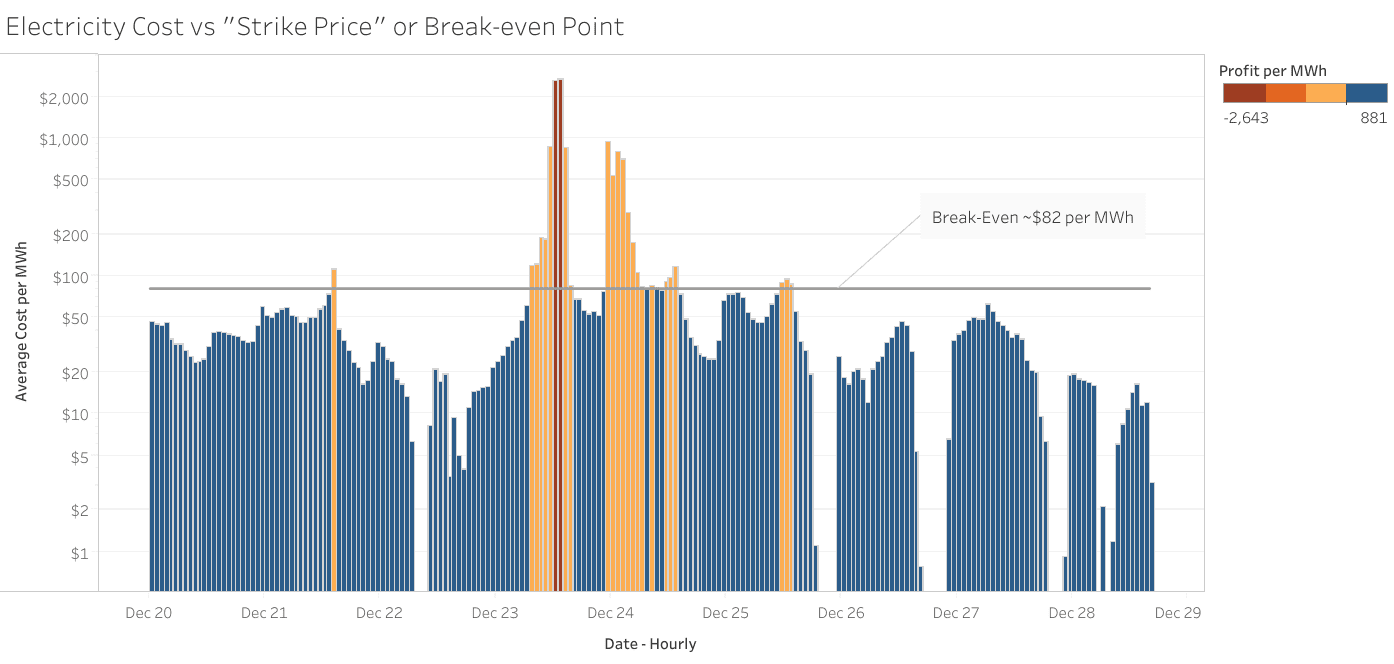

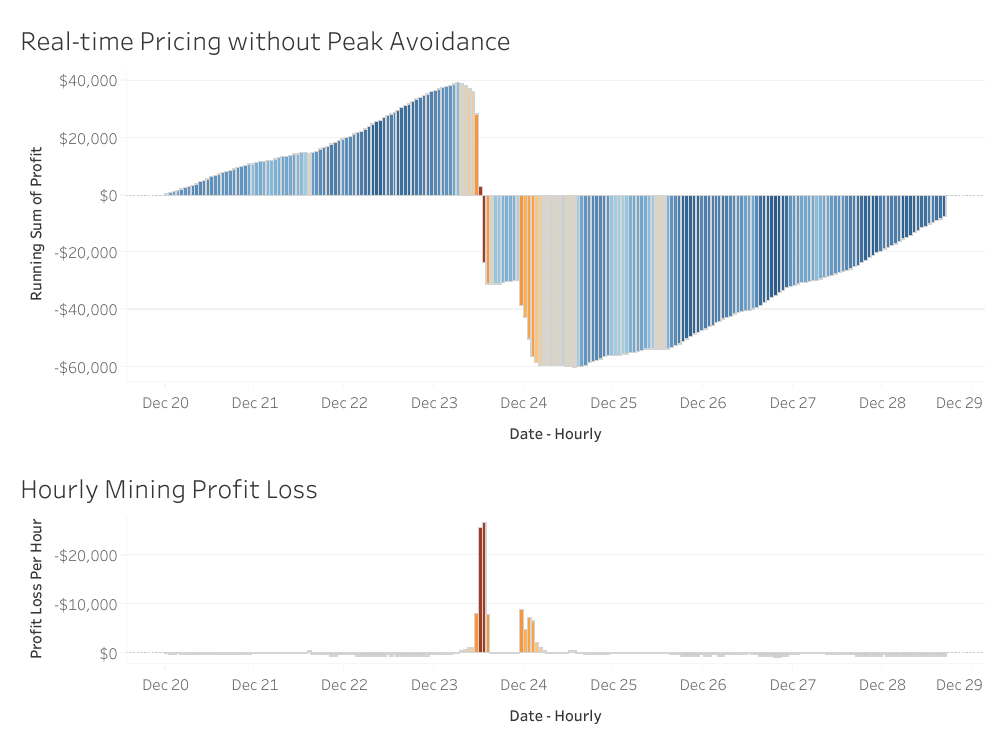

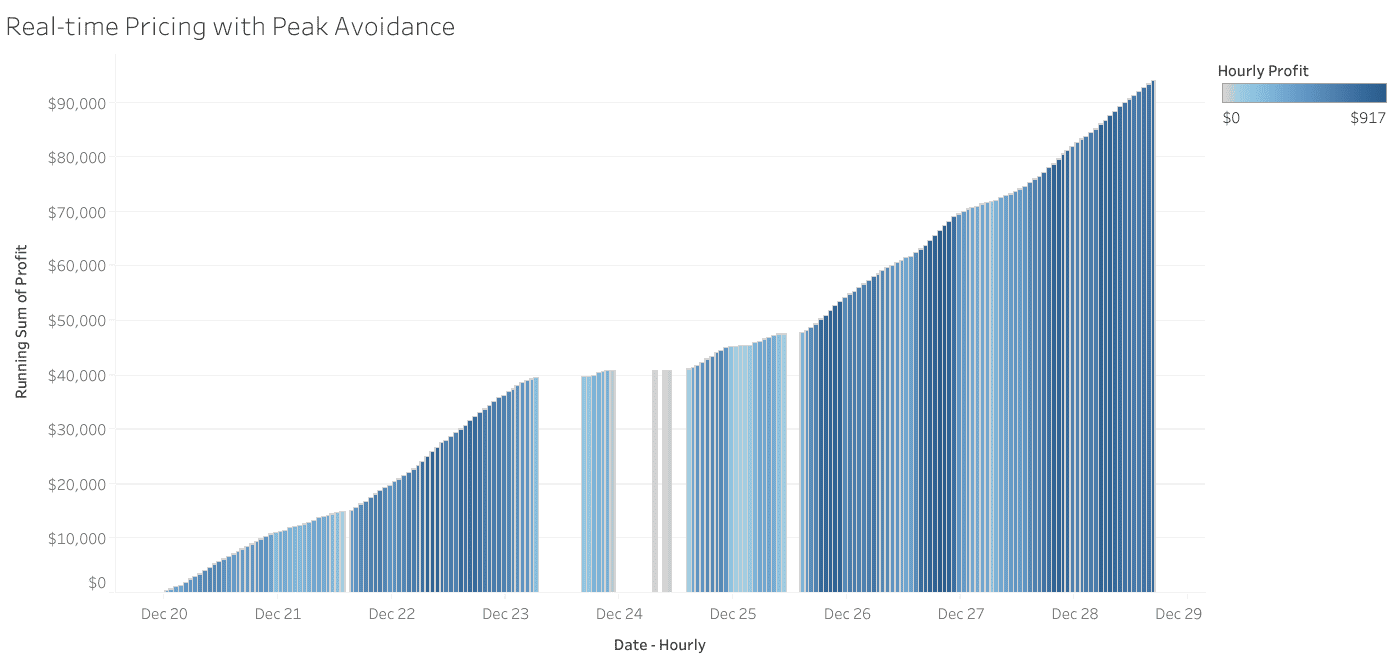

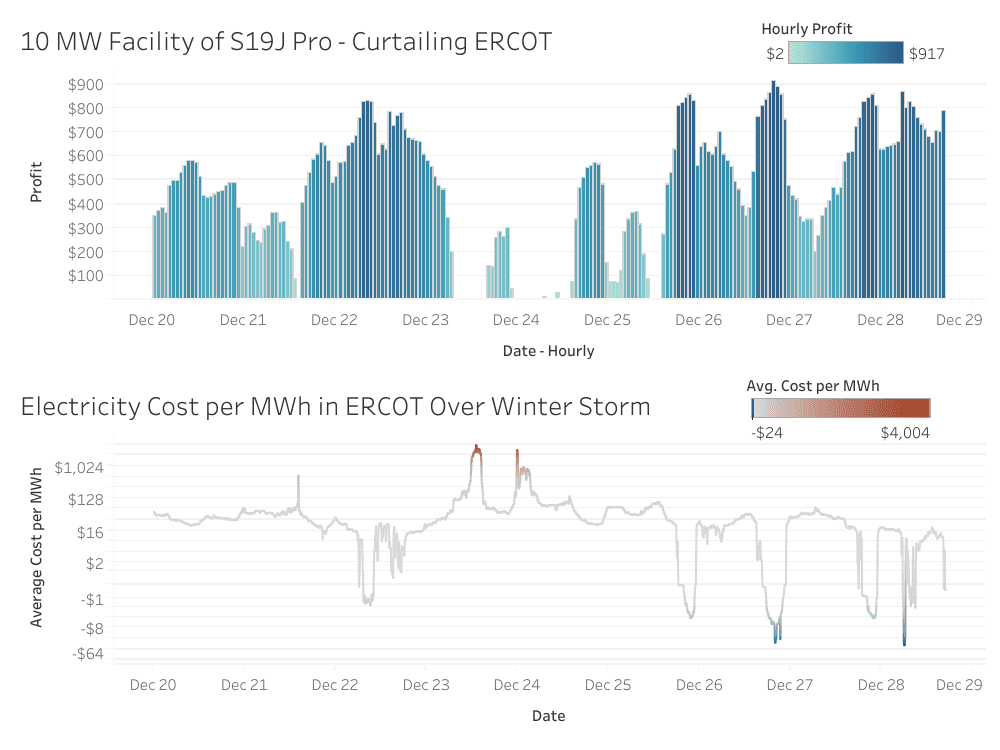

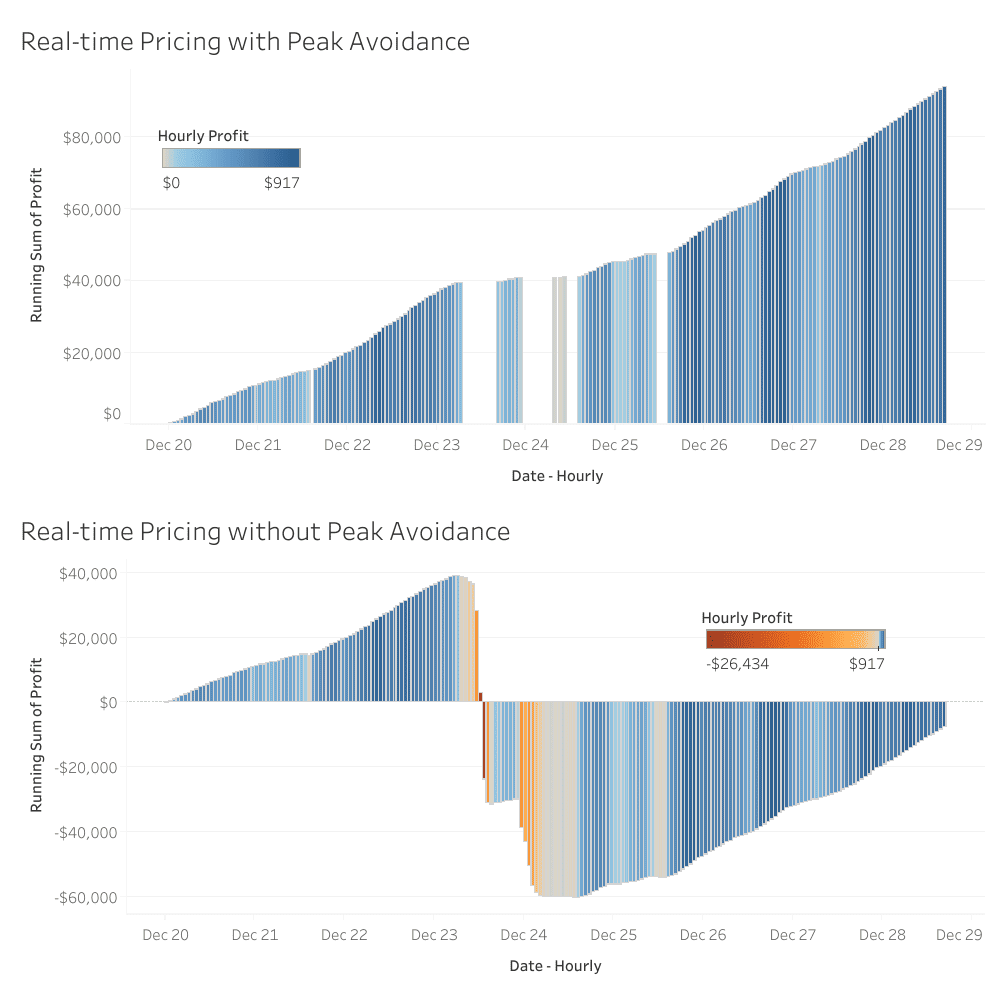

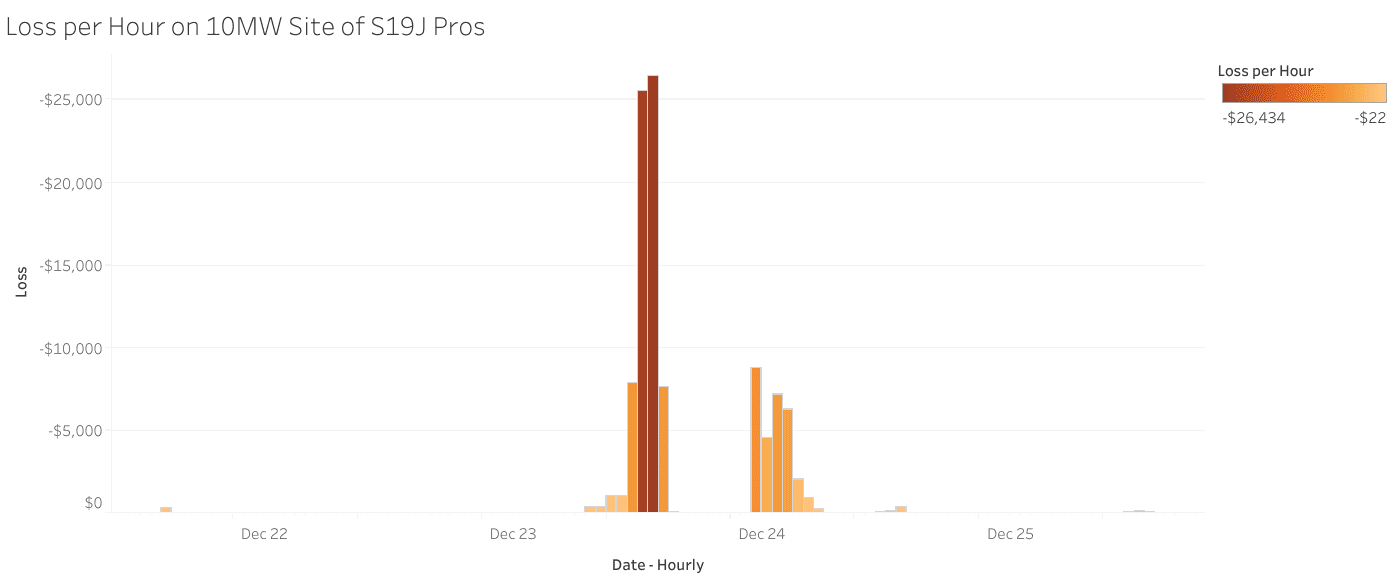

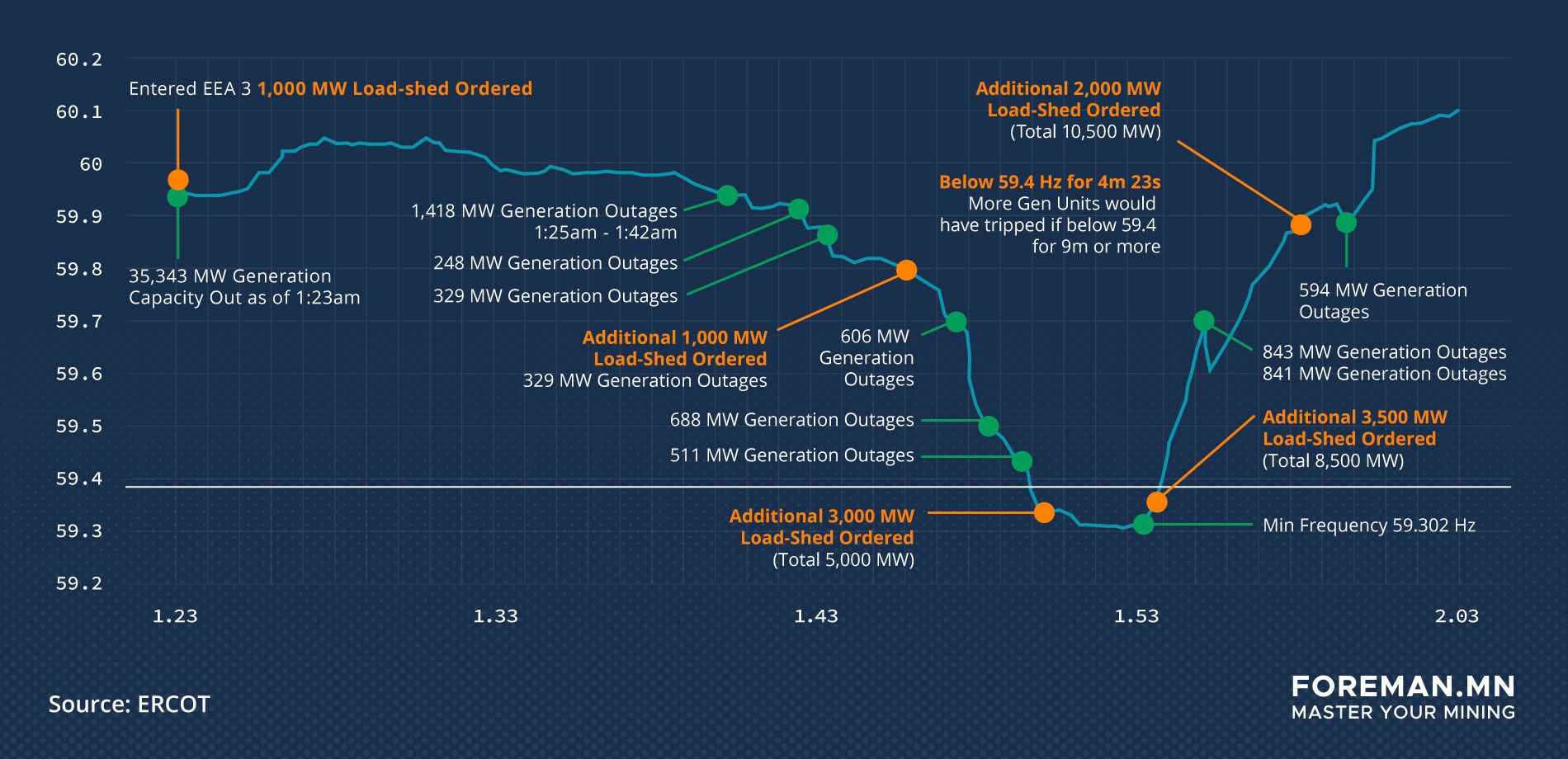

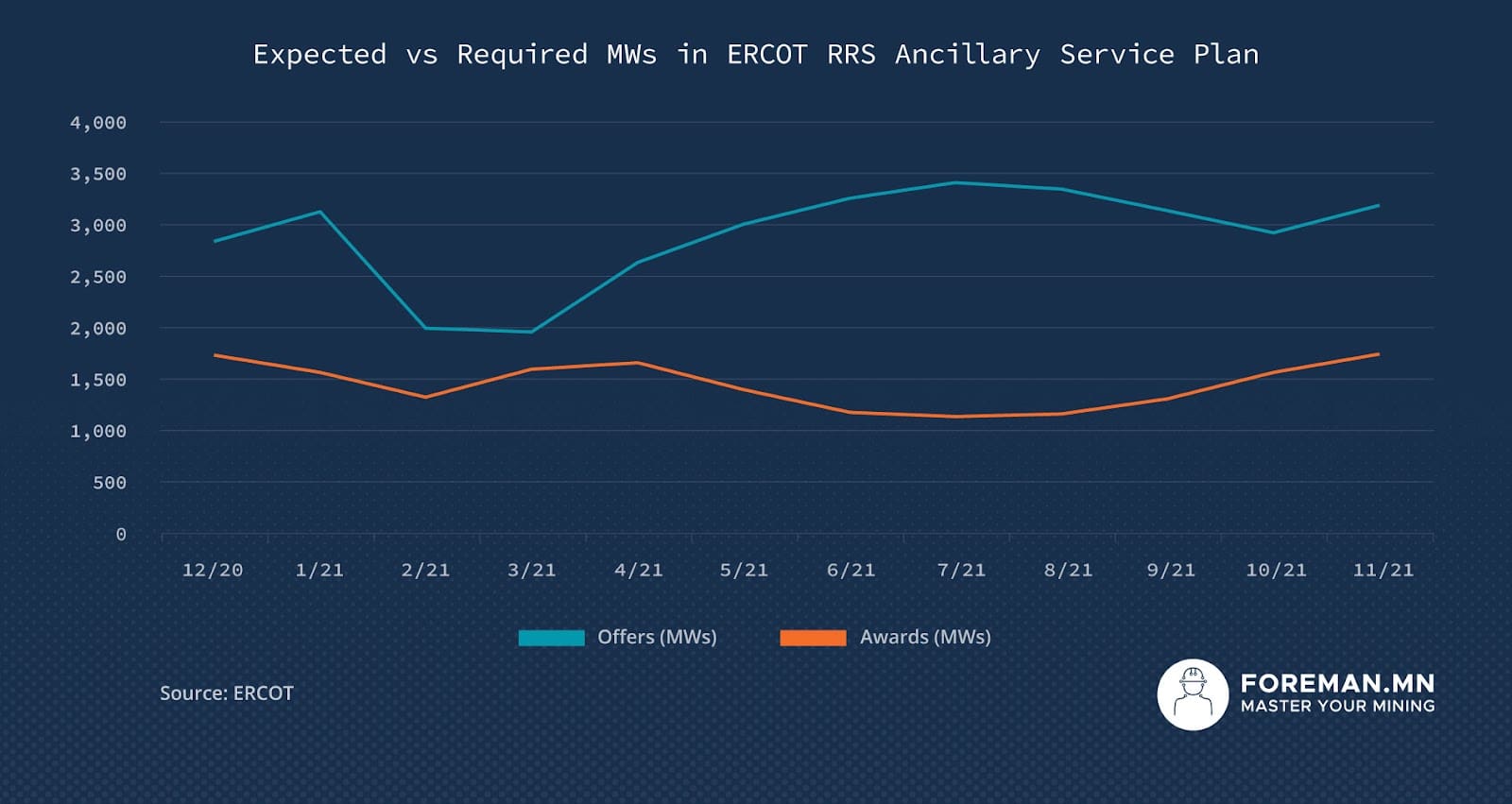

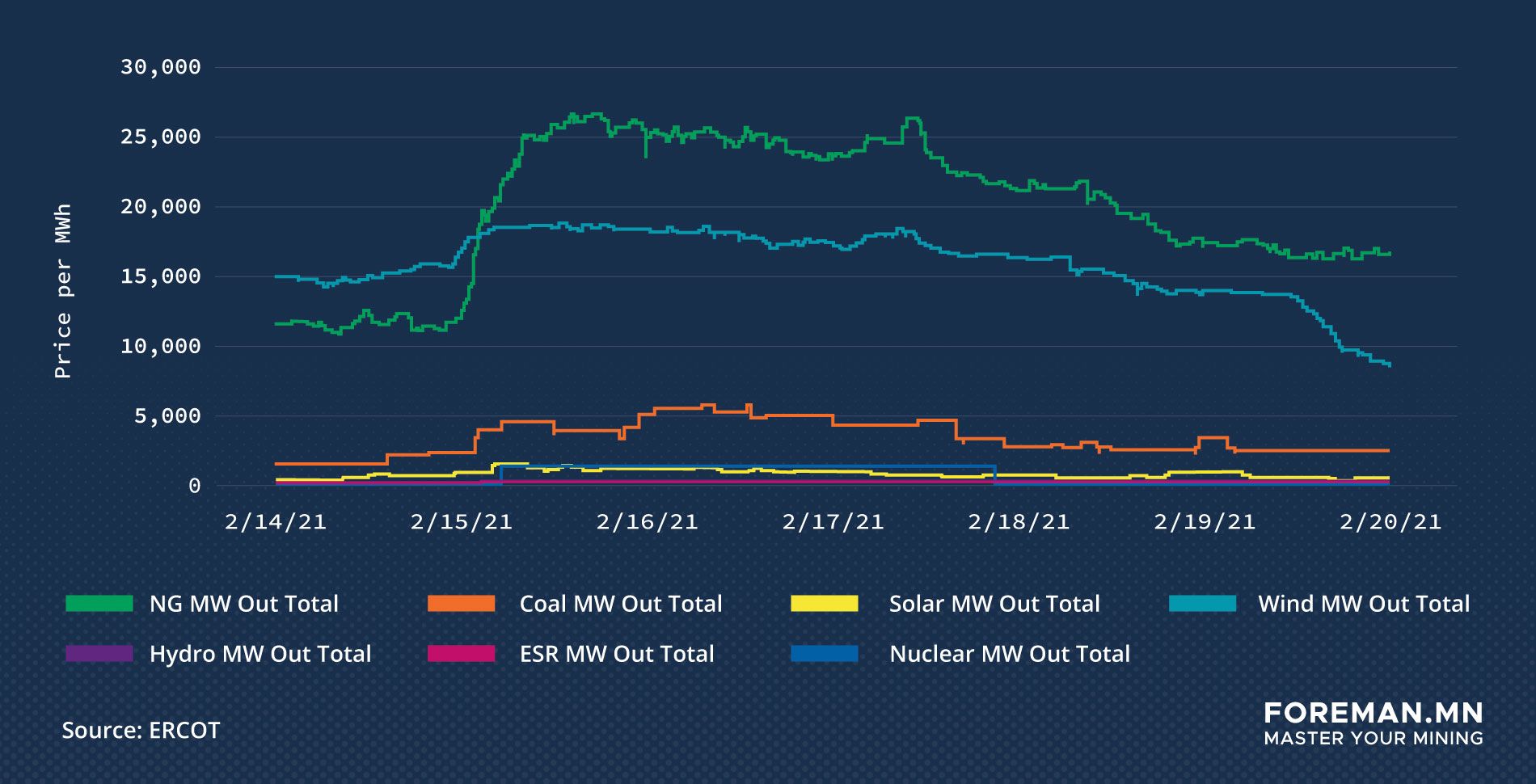

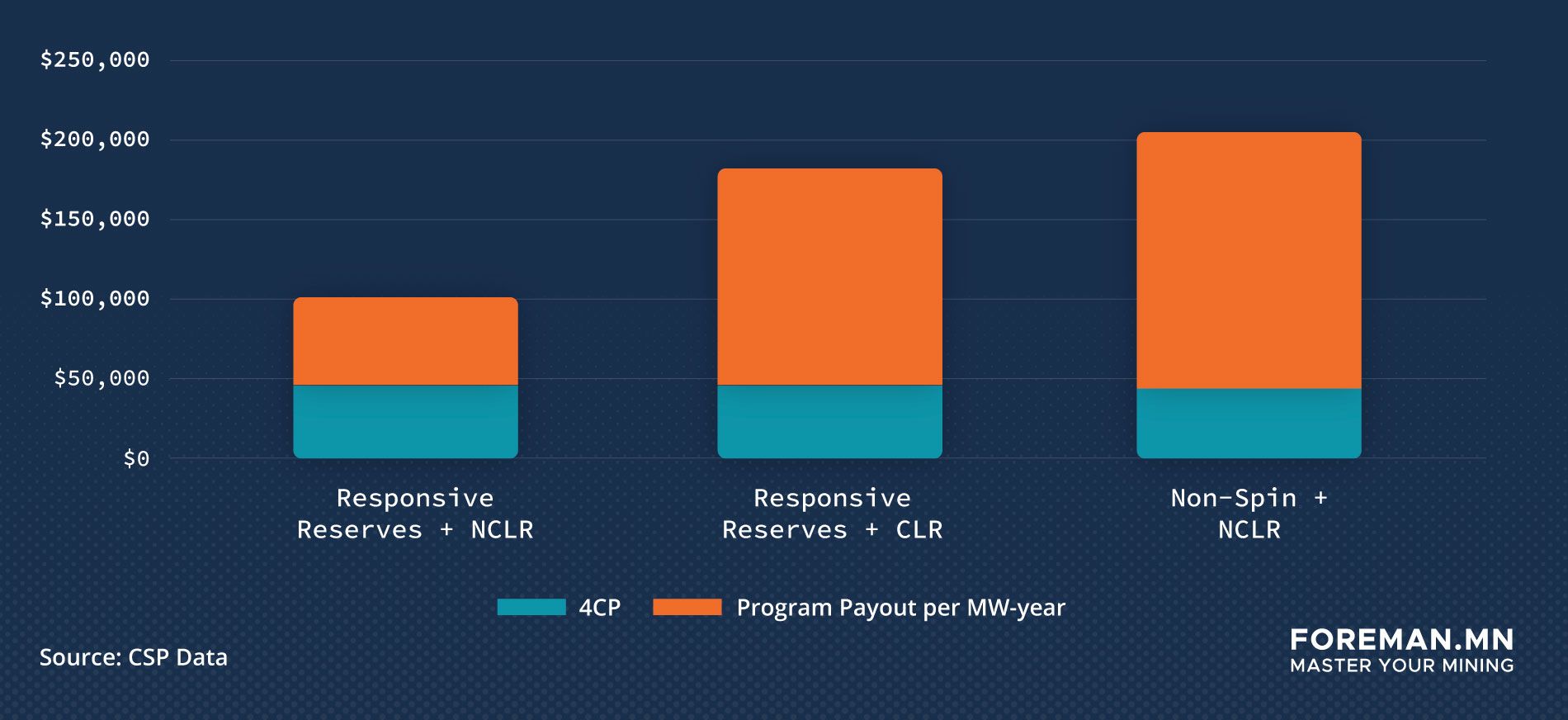

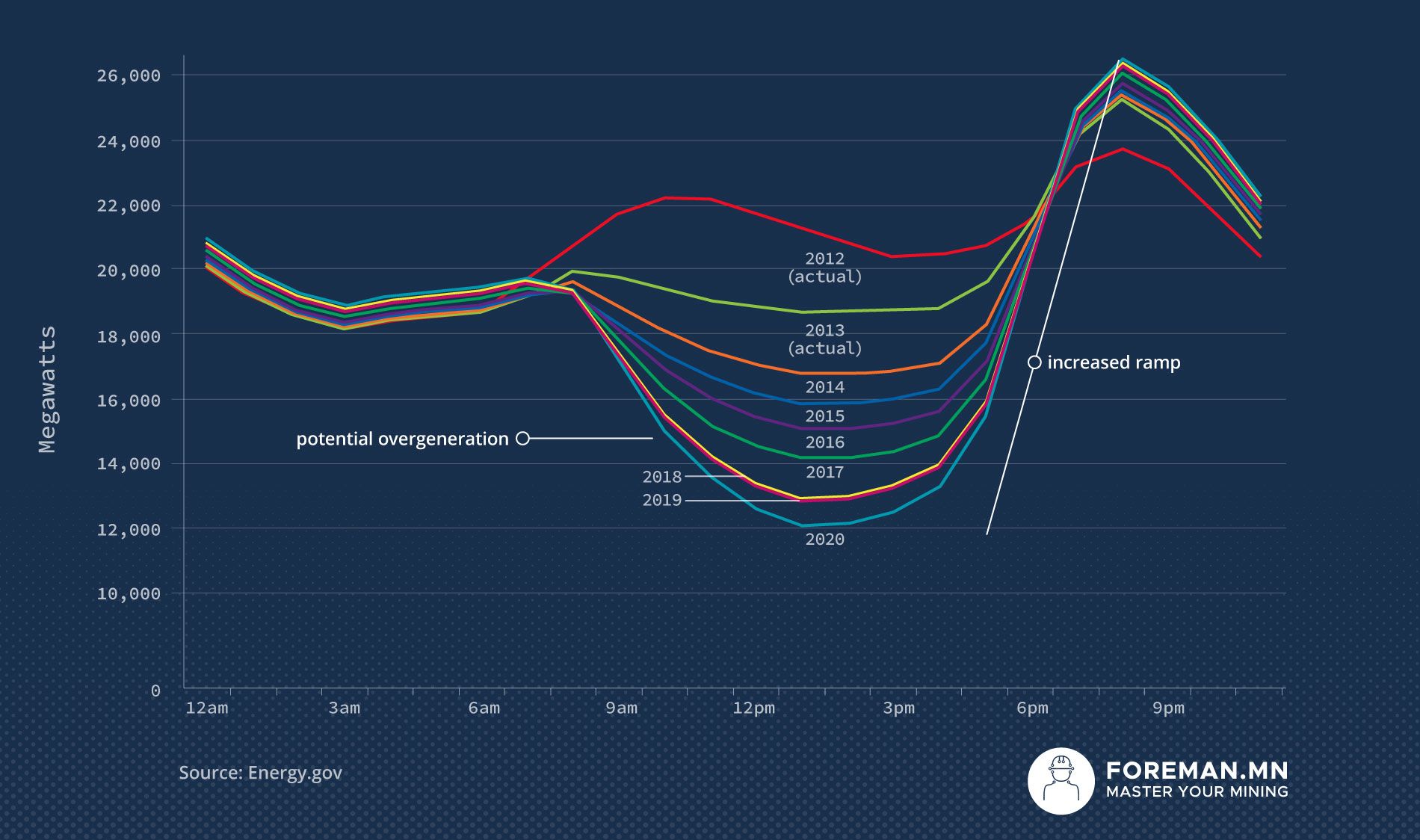

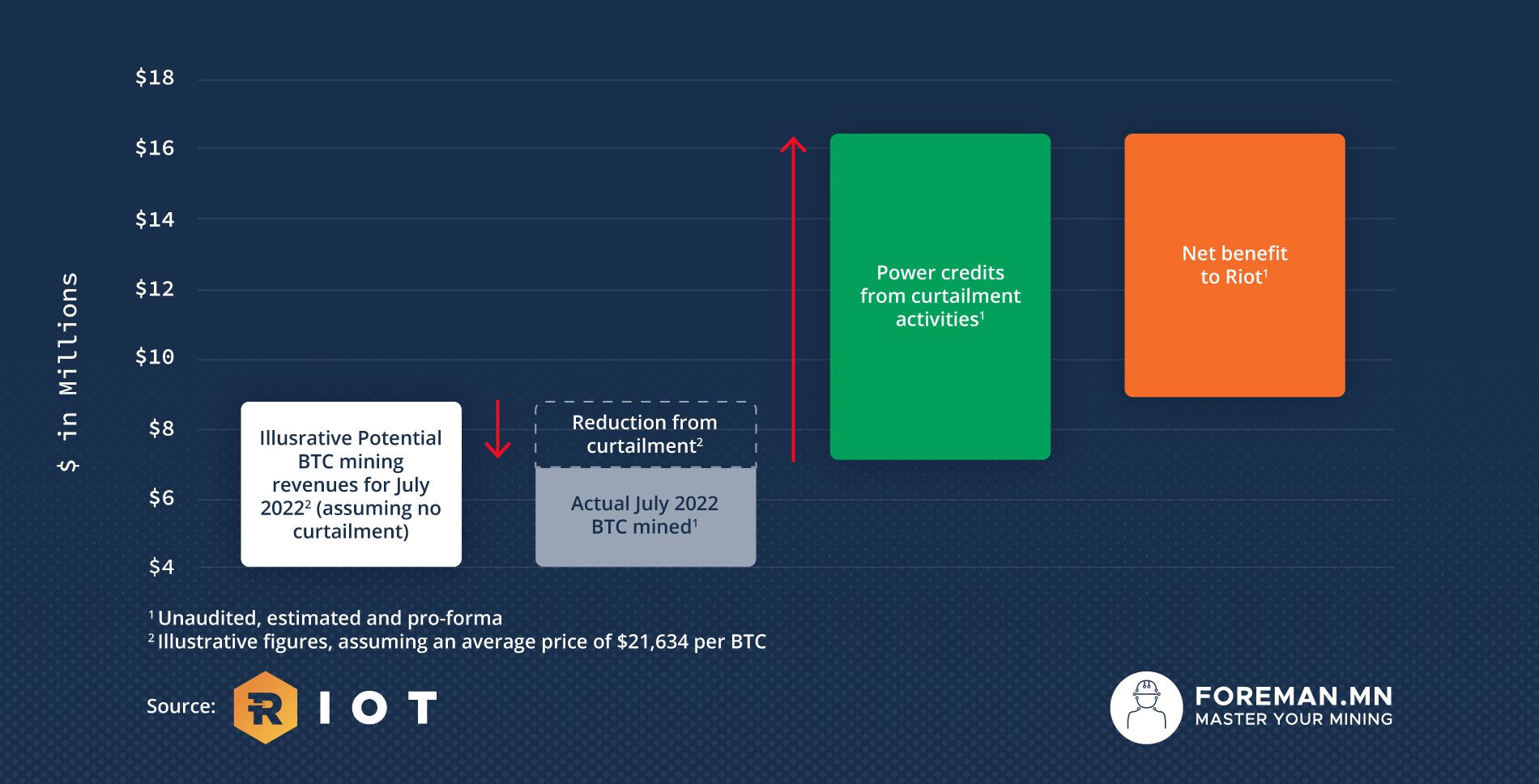

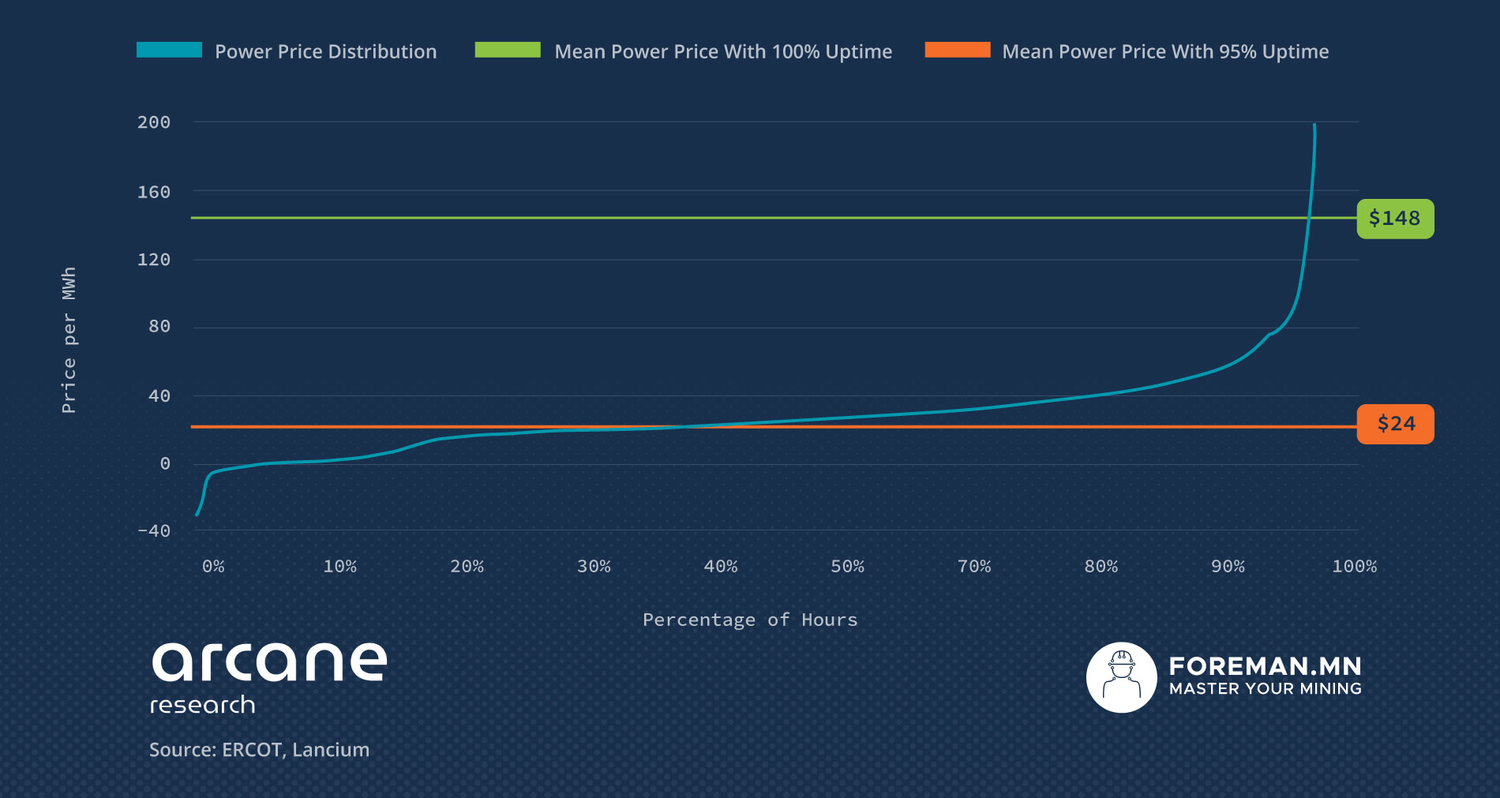

Demand Response (DR) is a provision commonly included in Power Purchase Agreements (PPAs) to help power purchasers manage energy costs during peak demand periods. Under a DR provision, the power purchaser agrees to reduce their electricity usage during these periods in exchange for a lower electricity price. This benefits the power generator and purchaser by allowing for better energy supply management and reducing expensive peaking power plants while supporting a more stable energy grid. However, DR provisions can be complex and require careful consideration of the purchaser’s and grid’s needs.

Types of PPAs

Various types of Power Purchase Agreements (PPAs) are available in the energy industry to suit different energy needs and preferences. Here are the most commonly used PPAs, each with unique features and advantages.

Physical PPAs: are contracts where the power generator sells physical electricity to the power purchaser at a fixed price over a specified term.

Virtual PPAs (vPPA): a financial contract between a power generator and a purchaser that settles cash flows based on the difference between contract and market electricity prices without requiring physical delivery of electricity. Usually used for energy price hedging.

Sleeved PPAs: involves a third party, usually a utility or energy retailer, facilitating electricity delivery from a generator to a purchaser, handling physical logistics while the parties agree on contract terms. It is used when direct procurement isn’t feasible due to constraints.

Uncontracted PPAs: Occurs when a power generator sells electricity directly to the wholesale market without a long-term agreement, exposing the generator to market price volatility and higher risks—essentially real-time markets.

Proxy Generation PPAs: virtual PPA variation used for variable-output energy projects, where financial settlements are based on estimated generation, called “proxy generation,” rather than actual output. Usually used for Variable energy sources such as wind, solar, and hydro.

Bitcoin miners typically use physical Power Purchase Agreements (PPAs) to secure a reliable and cost-effective electricity supply for their mining operations. Physical PPAs are contracts between a power generator and a power purchaser that involve the physical delivery of electricity from the generator to the purchaser. Additionally, physical PPAs can help Bitcoin miners mitigate the risks associated with fluctuations in energy prices and availability, which can significantly impact the profitability of their mining operations.

Benefits And Challenges Of PPAs

Benefits

When it comes to Bitcoin mining, PPAs offer several benefits and challenges. One of the main benefits of a PPA for Bitcoin miners is price stability. Since the cost of electricity is one of the main operational expenses for Bitcoin miners, a PPA can provide a stable and predictable price for electricity over a specified term, which can help miners manage their energy costs and mitigate risks associated with energy price volatility.

Another benefit of a PPA for Bitcoin miners is access to a long-term energy supply. A PPA can help miners secure a reliable source of energy, which is essential for the operation of mining rigs. This can help miners avoid interruptions to their operations and ensure they can access the energy needed to mine Bitcoin.

Challenges

However, several challenges are associated with using a PPA for Bitcoin mining. One of the main challenges is regulatory and legal risks. The Bitcoin mining market is still relatively new and unregulated, and there may be legal or regulatory obstacles that prevent the implementation of a PPA for mining operations.

Another challenge is credit risk. Bitcoin miners may face credit risks if they need more revenue to pay for the electricity they use under the terms of the PPA. Market risk is also a challenge, as the Bitcoin market is subject to significant price volatility, which can impact the profitability of mining operations.

Operational risks may also arise with implementing a PPA for Bitcoin mining, such as issues related to project management, construction delays, or technical problems with the energy infrastructure. PPAs can also be complex and involve multiple parties creating negotiation, administration, and enforcement challenges like in colocation facilities.

PPAs are complex contractual agreements that involve multiple parties and elements. The types of PPAs vary widely, and demand response is an important consideration. While there are many benefits to using a PPA, there are also several challenges to be aware of. By carefully considering these factors and working with experienced professionals, power generators and purchasers can develop and implement successful PPAs that meet their energy needs and support their goals, regardless of the generated energy source.

Subscribe to OBM’s Blog

More from OBM

OBM and Revolution Mining Achieve CLR Qualification Milestone in Texas

OBM Marks Next Phase of Growth as Flexible Load Management Leader with Fresh Brand and New Website

Turning Power Into Profit: How to Operationalize Revenue Opportunities with Confidence